4kodiak/iStock Unreleased via Getty Images

4kodiak/iStock Unreleased via Getty Images

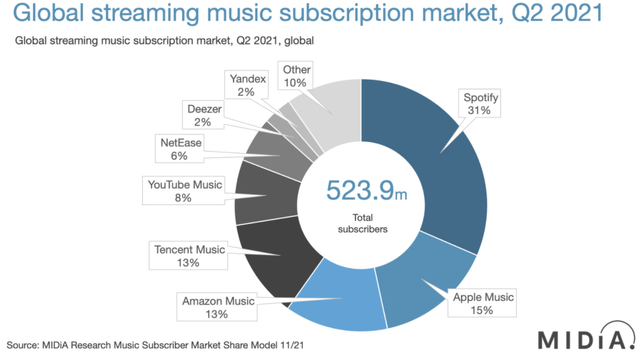

Amazon (NASDAQ:AMZN) has shown steady growth within its subscription business despite many analysts pointing to saturation of Prime members within US and important international regions. One of the key reasons could be the rapid growth in Amazon Music. Amazon had reported that Music Unlimited reached 55 million subscribers in early 2020. In comparison, Spotify (SPOT) has 180 million premium users according to recent earnings data. Apple Music (AAPL) had 60 million paid users in mid-2019, the last time it announced these numbers. Research report by MIDiA Research has placed Amazon Music marginally behind Apple Music. Amazon Music also has a much higher growth rate which can help it to dethrone Apple Music. It will soon be the main challenger to Spotify.

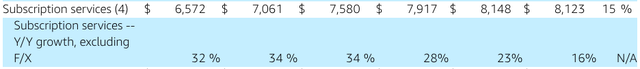

Recently, Amazon has increased the price of its music subscription for Prime members. The Prime membership fee itself has seen a big jump in the last month. This can be seen as a sign of confidence from the management in the loyalty towards their service. Amazon’s overall growth rate has been slowing down. However, its main growth engines like AWS, advertising and subscription business continue to see rapid growth.

The subscription growth is very important for future trajectory of the stock as it gives steady and recurring revenue for the company. Strong presence in the smart speaker segment and new home products could help Amazon deliver better growth in its music streaming business. We should see better bullish sentiment towards the stock as the company continues to show rapid improvement in subscription revenue on the back of its music streaming segment.

Amazon has reported over $30 billion in trailing twelve month revenue in its subscription business. It has already reported over 200 million Prime members globally. Amazon could soon see a saturation within its Prime membership as it covers most of the addressable market base in US and international regions. At this point, Amazon needs new services which can add further revenue streams to its subscription segment. Amazon Music is a key driver for future subscription revenue growth because of its size and its growth potential.

Midia Research

Midia Research

Figure 1: Major streaming music players. MIDiA Research

According to MIDiA Research, Amazon Music has a 13% market share globally within the music streaming industry. This is marginally behind Apple Music. The report also mentions that Amazon Music has shown a year on year growth of 27% while Apple Music reported growth of only 12%. It should be possible for Amazon to overtake Apple within the music streaming ranking. This would be very important for Wall Street because it shows the ability of Amazon to directly compete with Apple in a major service.

Company Filings

Company Filings

Figure 2: Amazon’s subscription service revenues for the past few quarters. Source: Company Filings

The music streaming industry reaches close to half a billion users globally. This is a massive market with a big runway for growth. If Amazon is to maintain its high growth rate in the subscription business, it would need to show progress in the music streaming subscription service. Amazon Music subscription should have reached at least 70 million subscribers according to the 2020 numbers announced and the above-mentioned growth rate.

At an average revenue per user of $80, it would contribute $5.6 billion to the subscription segment. This is close to 20% of the total subscription revenue. Hence, we can see that faster growth in Amazon Music in the next few quarters would be a big tailwind for the subscription business and the entire ecosystem of the company.

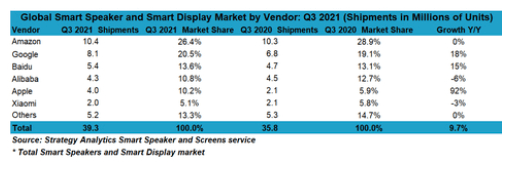

Amazon has a leadership position in the smart speaker segment. Apple has tried to gain a greater market share but has not been able to make good inroads in this segment. It had launched HomePod Mini at a rock bottom price in order to attract cost-conscious customers. This effort seems to be working according to the latest third party estimates. Strategy Analytics has reported that Amazon’s smart speaker and display business did not show any growth in the last quarter while Apple showed a staggering 92% growth. Most of this growth could be because of HomePod Mini and the low base of Apple.

Strategy Analytics

Strategy Analytics

Figure 3: Growth rate of different smart speaker and display vendors. Source: Strategy Analytics

Amazon is still far ahead of Apple in this race. Amazon is also launching a number of new products like Echo Show 15, Amazon Glow, Astro robot and others. This gives the company a better foothold in the home electronics market. It puts more Amazon screens in homes allowing the company to attract them to its services like Amazon Music.

Amazon seems to be holding back its punches in the music streaming industry. It has market leadership in smart speaker segment and has a strong Prime membership of over 200 million customers. The company is spending close to $15 billion annually on its video streaming platform. It should be quite easy for Amazon to rapidly increase the music streaming membership base by giving bigger discounts on its streaming service or discounting Echo devices.

It should not be surprising if Amazon gets close to the membership numbers of market leader Spotify by 2025. The company has enough resources to absorb losses and discounts. Strong music streaming customer base will also provide a halo effect to other services launched by the company.

We are still in the early stages of this industry. Amazon will increase its market share over the next few years as more smart speakers and smart displays enter daily usage. It should be possible for Amazon Music to hit 250 million paid users in the next five years with annual growth rate of 30%. This will be a big boost to Prime membership and could deliver revenue of close to $25 billion at an ARPU of $100.

Amazon could deliver over 20% annual subscription revenue growth on the back of its music streaming and international business. This would take subscription revenue to over $100 billion within the next five years. As a peer comparison, Netflix has consistently traded at P/S ratio of close to 10 prior to the recent correction. Amazon’s subscription business might get a better premium than Netflix due to its ecosystem and flywheel effect. Even at P/S ratio of 10, the subscription business alone would be valued at over a trillion dollars within the next five years. This shows that good growth in music streaming and subscription business can be the main driver for future stock growth for Amazon.

Amazon’s music streaming business is growing rapidly and is a key reason behind the strong subscription business growth of the company. It makes close to 20% of the subscription revenue. According to third party estimates, Amazon Music could soon overtake Apple Music. This would add to the bullish sentiment for Amazon stock as it shows a big success in a major service against Apple. If Amazon is able to retain its market lead in Echo products, it would provide a good ecosystem for services like music streaming.

The music streaming industry is still growing and Amazon could end up increasing its market share over the next few quarters as it further ties the Prime membership together with music streaming business. The subscription business alone could have a valuation of over a trillion dollars in the next five years as the company expands in international regions, improves music streaming customer base, and adds new services. Investors should closely watch the future trajectory of Amazon Music as it shows the long term potential of Amazon’s subscription business and the growth runway for the stock.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.