Mario Tama/Getty Images News

Mario Tama/Getty Images News

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three streaming service stocks. With Americans ditching TV providers and the radio at record numbers, should you consider these three streaming service stocks of Walt Disney Co., Netflix Inc. and Spotify Technology SA?

Americans are dropping traditional cable and satellite TV services faster than ever in favor of digital streaming services. Video streaming services allow users to watch movies and TV whenever and wherever they desire. Streaming providers’ catalogs are constantly growing with many offering thousands to choose from.

The global video streaming market size was valued at $59.14 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 21.3% from 2022 to 2030. Innovations such as blockchain technology and artificial intelligence (AI) are being used to improve video quality, which is expected to help grow the industry. Moreover, the rapid adoption of mobile phones owing to the growing popularity of social media platforms and other digital mediums for branding & marketing is anticipated to fuel the market growth.

Additionally, the coronavirus pandemic has positively impacted the global market size. In 2021 alone, the global streaming market grew 25%. According to a 2020 report by the Motion Picture Association, the number of online video on demand (VoD) users jumped to around 1.1 billion and is expected to reach 2 billion by 2023.

Long gone are the times of needing an iPod or MP3 player to listen to music on the go. Smartphones and the rise of digital music streaming have made listening to your favorite songs easier than ever. The largest music streaming services, Spotify and Apple Music, each have over 50 million songs available to subscribers who pay a small monthly fee. Many of these platforms also allow users to listen to podcasts and audiobooks.

The music streaming industry, while only valued at about half that of video streaming, is picking up steam, with a projected CAGR of 14.7% from 2022 to 2030. The rising use of 5G connectivity has become one of the most popular trends in the global market, allowing service providers to offer extremely high-quality audio streaming.

Overall, streaming service providers have grown rapidly in recent years and will likely grow at a much faster rate than most other industries. The advancement of technology and smart devices has allowed users to consume more digital and audio content than ever before. This, along with affordable pricing provides an opportunity to take control from traditional TV and radio service providers, leading to a bright outlook for streaming service providers.

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is one reason why AAII created the A+ Stock Grades, which evaluate companies across five factors that have been shown to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

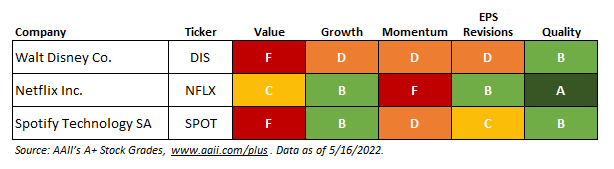

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three streaming service stocks-Disney, Netflix and Spotify-based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Streaming Service Stocks

American Association of Individual Investors

American Association of Individual Investors

Walt Disney Co. (DIS) is a worldwide entertainment company. Its segments include Disney Media and Entertainment Distribution (DMED) and Disney Parks, Experiences and Products (DPEP). The DMED segment encompasses the company’s global film and episodic television content production and distribution activities. The DMED lines of business consist of linear networks, direct-to-consumer and content sales/licensing. The DPEP segment business consists of the sale of admissions to theme parks, the sale of food, beverage and merchandise at its theme parks and resorts, sales of cruise vacations, sales and rentals of vacation club properties, royalties from licensing its intellectual properties (IP) for use on consumer goods and the sale of branded merchandise. The content sales/licensing business consists of selling film and episodic television content in the television and subscription video-on-demand (TV/SVOD) and home entertainment markets.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher grades, on average, outperformed stocks with lower grades over the period from 1998 through 2019.

Disney has a Quality Grade of B with a score of 64. The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross profit to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

The company ranks strongly in terms of its change in total liabilities to assets and F-Score. Disney has a change in total liabilities to assets of -1.4% and an F-Score of 7. The industry average change in total liabilities to assets is 2.2%, significantly worse than Disney’s. The F-Score is a number between zero and nine that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity and operating efficiency of a company. However, Disney ranks poorly in terms of its gross income to assets, in the 29th percentile.

Disney has a Momentum Grade of D, based on its Momentum Score of 32. This means that it ranks poorly in terms of its weighted relative strength over the last four quarters. This score is derived from an above-average relative price strength of 0.6% in the second-most-recent quarter and -2.5% in the fourth-most-recent quarter, offset by below-average relative price strengths of -22.2% and -14.7% one and three quarters ago, respectively. The scores are 28, 65, 22 and 71 sequentially from the most recent quarter. The weighted four-quarter relative price strength is -12.2%, which translates to a score of 32. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weighting of 20%.

The company has a Value Grade of F, based on its Value Score of 82, which is considered to be ultra expensive. This is derived from a very high price-earnings (P/E) ratio of 72.6 and a price-to-free-cash-flow (P/FCF) ratio of 126.7, which ranks in the 94th percentile. Disney has a Growth Grade of D based on a strong quarterly year-over-year operating cash flow growth of 27.2%, offset by a poor five-year earnings per share (EPS) growth rate of -28%.

Netflix Inc. (NFLX) is an entertainment services company. The company has paid streaming memberships in over 190 countries, and it allows members to watch a variety of television series, documentaries, feature films and mobile games across a variety of genres and languages. Members can watch as much as they want at any time. Members can play, pause and resume watching, without commercials. Additionally, the company offers its DVD-by-mail service in the U.S. It offers a variety of streaming membership plans, the price of which varies by country and the features of the plan. The pricing of its plans ranges from approximately $2 to $27 per month. Members can watch streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes and mobile devices. The company acquires, licenses and produces content, including original programming.

Earnings estimate revisions offer an indication of how analysts are viewing the short-term prospects of a firm. Netflix has an Earnings Estimate Revisions Grade of B, which is considered positive. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months.

Netflix reported a positive earnings surprise for first-quarter 2022 of 22%, and in the prior quarter reported a positive earnings surprise of 62%. Over the last month, the consensus earnings estimate for the second quarter of 2022 has decreased from $3.007 to $2.966 per share due to 12 upward and 18 downward revisions. Over the last three months, the consensus earnings estimate for full-year 2022 has increased 0.1% from $10.890 to $10.901 per share, based on 17 upward and 18 downward revisions.

The company has a Value Grade of C, based on its Value Score of 59, which is considered average.

Netflix’s Value Score ranking is based on several traditional valuation metrics. The company has a score of 44 for shareholder yield, 37 for the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA) and 54 for the price-earnings ratio (remember, the lower the score the better for value). The company has a shareholder yield of -0.2%, an EV/EBITDA ratio of 8.5 and a 17.9 price-earnings ratio. A lower price-earnings ratio is considered better value, and Netflix’s price-earnings ratio is below the sector median of 21.1. The price-to-sales ratio and price-to-book-value ratio are the only valuation metrics for the company that are worse than the industry median.

The Value Grade is the percentile rank of the average of the percentile ranks of the valuation metrics mentioned above along with the price-to-free-cash-flow ratio.

Netflix has a Quality Grade of A, based on its Quality Score of 83, which is considered very strong. This is based on a high return on invested capital of 95.4% and a high return on assets score of 87. The return on assets indicates how profitable a company is in relation to its total assets. The higher the return on assets, the more efficient and productive a company is at managing its balance sheet to generate profits. The only quality metric for the company that is worse than the industry median is accruals to assets with a score of 6.

Spotify Technology SA (SPOT) is a Luxembourg-based company that offers digital music streaming services. The company enables users to discover new releases, which includes the latest singles and albums; playlists, which include ready-made playlists put together by music fans and experts and millions of songs so that users can play their favorites, discover new tracks and build a personalized collection. Users can either select Spotify Free, which includes only shuffle play, or Spotify Premium, which encompasses a range of features, such as shuffle play, no ads, unlimited skips, offline listening, ability to play any track and high-quality audio. The company operates through a number of subsidiaries, including Spotify Ltd., and is present in over 20 countries.

Spotify has a Quality Grade of B with a score of 69. The company ranks strongly in terms of its gross income to assets and F-Score. Spotify has a gross income to assets of 38.6% and an F-Score of 8. The industry average gross income to assets is 26.9%, significantly worse than Spotify’s. Spotify’s F-Score is in the 95th percentile of all stocks, with the sector median being 3. However, Spotify ranks poorly in terms of its return on invested capital, in the 28th percentile.

Spotify reported a positive earnings surprise for first-quarter 2022 of 187.9%, and in the prior quarter reported a positive earnings surprise of 50.6%. Over the last month, the consensus estimate for the second quarter of 2022 has decreased from positive earnings of $0.015 to a loss of $.601 per share due to one upward and 19 downward revisions. Over the last three months, the consensus earnings estimate for full-year 2022 has decreased 18.5% from a loss of $0.542 to a loss of $0.642 per share based on four upward and 12 downward revisions.

The company has a Value Grade of F, based on its Value Score of 92, which is considered to be ultra expensive. This is derived from a very high price-earnings ratio of 278.4 and an enterprise-value-to-EBITDA ratio of 128, which ranks in the 97th percentile. Spotify has a Growth Grade of B based on a score of 75. The company has strong five-year operating cash flow growth of 29% and quarterly year-over-year earnings per share growth of 454.3%. This is offset by a poor quarterly year-over-year operating cash flow growth rate of -43.1%.

____

The stocks meeting the criteria of the approach do not represent a “recommended” or “buy” list. It is important to perform due diligence.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.